1. Investor Demand and Policy Development Signal Strong Growth Prospects for Responsible Investment

In 2022, investors and regulators laid the foundation for future sustainability policy development. Here are some of the environmental, social, and governance (ESG) initiatives and regulatory changes that made history during that time.

January

March

June

July

August

December

Read the full report

Download the pdf file to read our full Responsible Investment 2022 Annual Report

Building Momentum in the RI Sphere

Interest in Responsible investment is growing.

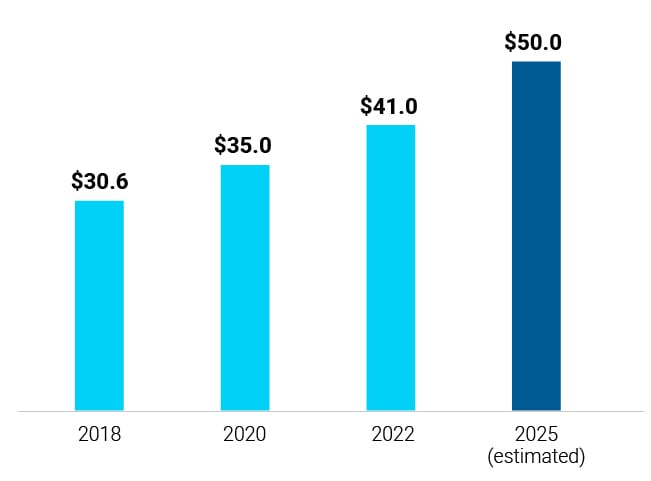

ESG Assets Under Management (AUM) Worldwide, 2018-2025 ($ trillions)

Global AUM for ESG products has continued its impressive growth trajectory, with assets valued at $41 trillion in 2022 and expected to rise to $50 trillion in 2025ii.

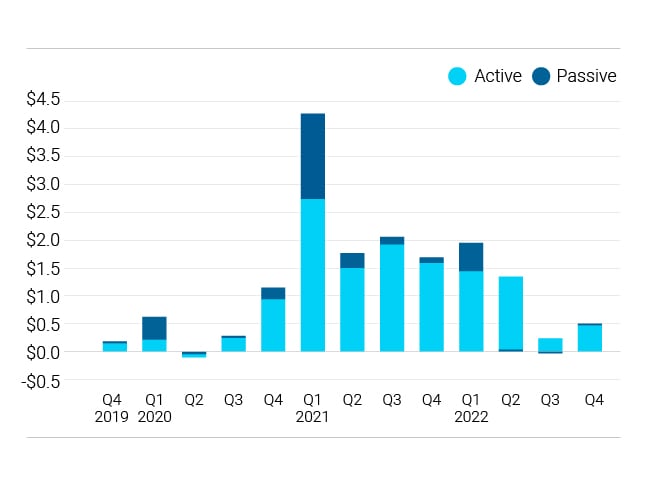

Canada Sustainable Fund Flows ($ billions)

Globally, investment flowing into RI funds held up better than the broader market, and in Canada, remained positive throughout 2022iii.

2. Amplifying Engagement Across Canada and Abroad

We increased our engagement efforts from 1,300 activities in 2021 to 1,938 in 2022.

This encompasses engagement conducted by both the Responsible Investment team at BMO GAM and the Responsible Engagement Overlay (reo®), a pooled engagement service with global reach. Together, we can amplify our impact on behalf of our clients.

1,938

engagement activities

848

companies engaged

282

milestones achievediv

Engagements

Environmental, Social, and Governance

3. Making Our Vote Count Toward Real-World Change

We strive to be as transparent as possible, which is why public details of all our voting activity, including the rationale for votes against management, are available on our Mutual Funds Proxy Voting Dashboard and Exchange Traded Funds Proxy Voting Dashboard.

65,688

22%

of items voted against management

6,441

company meetings voted

60%

of shareholder proposals supported

Making Progress on Board Diversity

In 2022, we withheld our support for 108 chairs of nominating committees for lack of board diversity (gender and/or ethnicity) in Canada. However, we were able to support over half of the 55 boards we withheld support from in 2021 because of improvements in board diversity.

Case Study: In May 2022, Northland Power announced that it amended its diversity policy to include a 2024 target for the recruitment and appointment of a board director who identifies as a member of one or more designated groups, including Indigenous peoples, persons with disabilities, persons belonging to visible minorities and members of the lesbian, gay, bisexual, transgender, queer or questioning and two-spirit (LGBTQ2S+) community. We had previously engaged with the company during the 2022 proxy voting season to discuss our expectations regarding diversity beyond gender.

4. Shaping National and Global Policy

In 2022, we saw a significant amount of regulatory and standards development that could influence companies and their investors for decades to come.

Through policy advocacy, we provide our investor perspective on proposed regulatory developments and industry standards to move the needle on sustainability practices across sectors and jurisdictions.

CSA Climate-related Disclosures

We submitted a BMO GAM comment letter to the CSA’s proposals on mandating climate-related disclosures for corporate issuers, encouraging stronger alignment with the Task Force on Climate-related Financial Disclosures (TCFD) pillars and international standards.

U.S. Department of Labor (DOL) Final Rule on Prudence and Loyalty

We wrote to the U.S. DOL to express concerns about its Employee Retirement Income Security Act (ERISA) proposal. In late 2022, the DOL recognized that the exercise of voting and other shareholder rights connected to shares of stock are, in fact, fiduciary acts.

International Financial Reporting Standards (IFRS) Sustainability and Climate Disclosures

We promoted a double materiality approach in the development of International Sustainability Standards Board (ISSB) standards to align with disclosure information investors need to advance sustainability versus only managing financial risks related to ESG issues.

A Policy Advocacy Win

We were pleased when during COP15 in Montreal, the IFRS’ ISSB clearly articulated the relationship between sustainability matters and financial value creation, with the definition of sustainability including a company’s ability to manage its impacts on resources and relationships.

We believe this is a crucial development that can move corporate reporting on financially material sustainability issues beyond a risk-only based ESG lens towards a more holistic focus on long-term value creation and sustainable outcomes.

5. Leaving Our Mark on the Industry

We believe, collaborating with other investors through joint initiatives, industry associations or collaborative engagements is key to accelerating positive change.

4

16

initiatives in total

31%

We became a lead engager for several Canadian investee companies through Climate Engagement Canada (CEC). We also joined collaborative engagements on Canadian companies through Farm Animal Investment Risk and Return (FAIRR) and the UN Principles for Responsible Investment’s Advance.

In doing so, we became the first Canadian asset management firm to formally support the Workforce Disclosure Initiative (WDI), which gathers workforce-related data from companies—making it consistent and comparable for investors.

6. Taking Home the RIA Leadership Award for Stewardship

BMO GAM was proud to be the Responsible Investment Association (RIA)’s 2022 Stewardship winner, being recognized for our comprehensive approach to advancing the energy transition in Canada.

7. Making Strides in Climate Action

We consider the evaluation of climate risks to be an essential component of investor due diligence and our responsible investing strategy. This commitment is manifested through our Climate Action Approach.

998

climate action-focused engagements

538

companies engaged on climate action

111

climate action-related milestones achieved

As a founding signatory to the Net Zero Asset Managers (NZAM) initiative, BMO GAM has committed to working with our investee companies to achieve net-zero emissions across all our AUM by 2050 or sooner.

In 2022, a portion of our funds were managed in line with the attainment of net zero. This proportion of assets, totalling 11.7% of our total AUM and valued at US$12.5B (as of June 30, 2022), was selected from our actively managed equity and fixed income portfolios that could be assessed through the Paris Aligned Investor Initiative’s Net Zero Investment Framework methodology.

Read the full report

Download the pdf file to read our full Responsible Investment 2022 Annual Report

8. Gaining Ground on Social Equality Issues

We formulated and published our Social Equality Approach to outline how we view growing social inequality as a systemic risk that will jeopardize long-term value creation.

734

social equality-focused engagements

364

companies engaged on social equality

33

social equality-related milestones achieved

Several macro-level forces were at work in 2022, increasing pressure on companies and investors to respect human rights.

In response, we undertook a deep-dive research project to better understand how large Canadian companies across major sectors are performing on human rights due diligence (HRDD). The report spanned six sectors and 29 companies, using two benchmark methodologies, including “Know the Chain” and “Corporate HR.”

Through our engagement with the Reconciliation and Responsible Investor Initiative, the First Nations Financial Management Board and BMO’s own Indigenous Advisory Council and Indigenous Banking Unit, we are developing best practice insights on working with investee companies to respect Indigenous rights and reconciliation.

To help broaden market awareness, we produced a podcast with the First Nations Financial Management Board.

9. Building Our Library of ESG Knowledge

Over 2022, our thought leaders published 17 pieces aiming to share BMO GAM’s approach, research and insights with clients and the broader RI industry—at the same time, informing and prioritizing our work internally. Here is a selection of our thought leadership from the year.

No one organization can become sustainable on its own. It’s very much an interconnected web, and by working together, we can develop effective solutions to complex issues.

In building our RI expertise, we aim to help investors achieve their responsible investing goals through better risk management, which can potentially result in greater long-term returns and alignment with values.

Our dedicated RI team collaborates with portfolio managers and analysts to consider ESG factors in the investment process for relevant mandates, while advancing a sustainable future through engagement, proxy voting, policy advocacy and thought leadership.

10. Turning Our Depth of ESG Expertise into Real Solutions

We have a dedicated range of BMO ESG ETFs and actively managed responsible investment branded funds designed for investors who wish to set the bar even higher for responsible investment.

BMO MSCI ACWI Paris Aligned Climate Equity Index ETF (ZGRN)

BMO Clean Energy Index ETF (Ticker: ZCLN)

BMO Balanced ESG ETF (Ticker: ZESG)

BMO Sustainable Opportunities Canadian Equity Fund

BMO Sustainable Bond Fund

BMO Sustainable Portfolios

Here’s What Our Investment Teams Were Up to in 2022

Our investment teams consider material ESG and other factors in their decision-making for relevant mandates, supported by our RI team’s research, data curation and tools. Click on the tabs below to see specific examples of our diverse methods at work.

Investee company Manulife’s board revised its director tenure policy to include a limit of 12 years of board service, aligned with our good governance expectations. We believe this is the best practice in Canada and are pleased to see such progress, as we had proactively communicated our views on tenure. We are also encouraged by Manulife’s strengthening of board oversight on ESG matters.

In partnership with reo®, a third-party engagement service provider, and the RI team, the Fundamental Equity team met with The Walt Disney Company to discuss diversity, equity and inclusion (DE&I) matters, encouraging them to set quantitative diversity targets and enhance reporting. The company has added DE&I as a performance metric in their executive compensation program.

The Disciplined Equity and RI teams met Bombardier Recreational Products (BRP)’s general counsel to discuss their human rights practices after the Russian-Ukraine war and encouraged them to perform due diligence on suppliers. We gave BRP kudos for suspending exports to Russia and donating to Ukraine relief efforts while continuing to support local employees.

The BMO Clean Energy Index ETF (ticker: ZCLN) tracks the S&P Global Clean Energy Index providing exposure to up to 100 companies from around the world involved in clean energy-related businesses. This ETF also excludes controversial companies and applies a carbon intensity screen to remove the highest emitters.

The BMO Sustainable Bond Fund, which is a holding in the Sustainable Portfolios managed by MAST, invests in high-quality companies that demonstrate a commitment to ESG considerations. The UN SDGs serve as a useful reference for incorporating sustainability themes. We consider ESG, alongside other factors, throughout our entire investment process, backed by our robust credit research, with critical input from BMO GAM’s RI team.

[i] Correia, Joel E. “The UN Just Declared a New Human Right.” The World Economic Forum, 9 Aug. 2022, https://www.weforum.org/agenda/2022/08/the-un-just-declared-a-universal-human-right-to-a-healthy-sustainable-environment-here-s-where-resolutions-like-this-can-lead/.

[ii] Bloomberg as cited in company blog, January 24, 2022.

[iii] “Global Sustainable Fund Flows: Q4 2022 in Review European investors show continued appetite for ESG products despite headwinds, while U.S. investors retreat.” Morningstar, 26 Jan. 2023, www.morningstar.com/lp/global-esg-flows.

[iv] A milestone is considered when a company makes tangible improvements in its policies and practices that align with our voting and engagement activities.

Disclosure

This report is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI or Bloomberg and they each bear no liability with respect to any such ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI or Bloomberg have with the Manager and any related ETF. Commissions, management fees and expenses (if applicable) may be associated with investments in mutual funds and exchange traded funds (ETFs). Trailing commissions may be associated with investments in mutual funds. Please read the fund facts, ETF Facts or prospectus of the relevant mutual fund or ETF before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in BMO Mutual Funds or BMO ETFs, please see the specific risks set out in the prospectus of the relevant mutual fund or ETF. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Mutual Funds are managed by BMO Investments Inc., an investment fund manager and a separate legal entity from Bank of Montreal. BMO ETFs are managed by BMO Asset Management Inc., an investment fund manager and a portfolio manager and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management, are designed specifically for various categories of investors in Canada and may not be available to all investors. Products and services are only offered to investors in Canada in accordance with applicable laws and regulatory requirements.®/™ Registered trademarks/trademark of Bank of Montreal, used under licence.