2023 proxy voting season1 highlights

Global

55,132

17.5%

Votes against Management

USA

18,000

18%

Votes against Management

67%

ESG Shareholder Proposals supported and abstained

Canada

6,253

19%

Votes against Management

52%

A season of highs and lows

2023 voting approach

2023 Overview

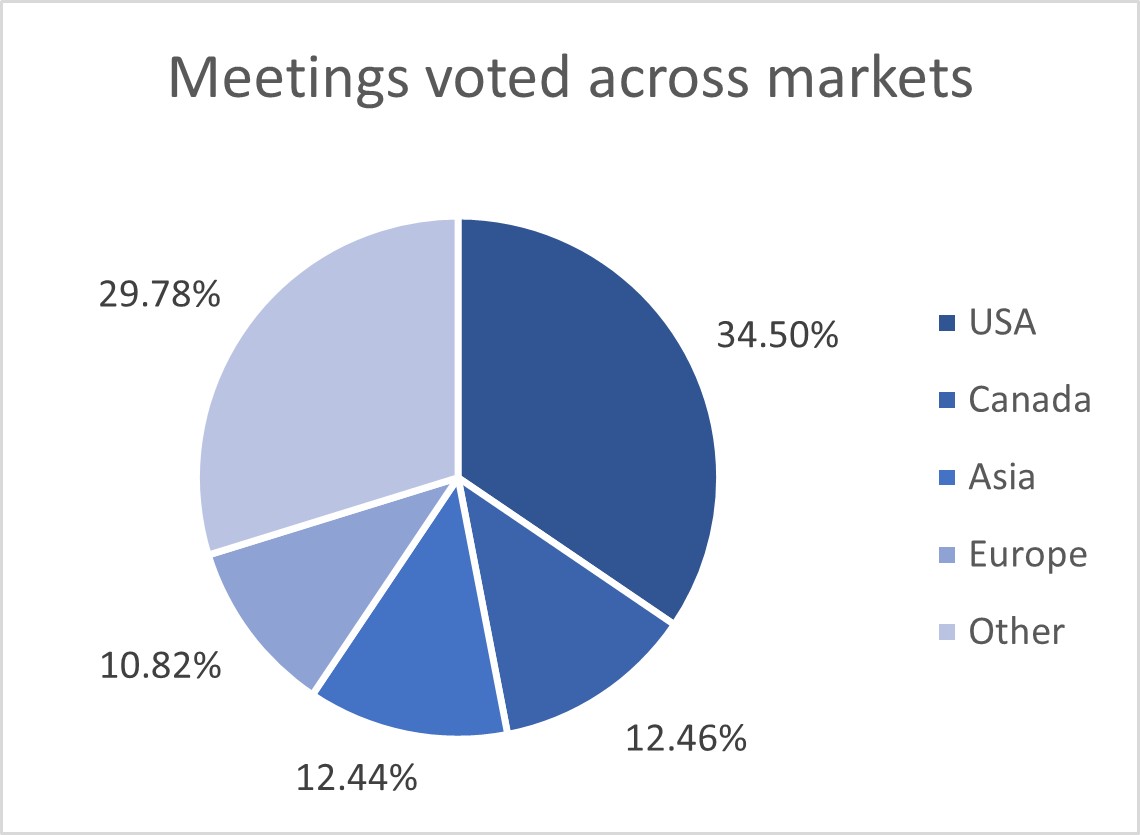

In Canada we voted against management 19% of items, which is consistent with our approach in 2022. Our votes against management affected 518 meetings, representing 78% of all meetings voted in the Canadian market. Figure 2 shows an overview of our number of votes with and against management per meeting items, by geography. We further discuss our votes on management items and shareholder proposals including interesting case studies, below.

Figure 2: Global volume of votes for and against management (VAM) by item. Source: BMO Global Asset Management, as of June 30th, 2023

Voting on Management Proposals

Key themes and concerns that led to votes against

The main management proposals that shareholders typically get to vote on are director elections, auditor ratification, executive compensation (in some markets like Canada, offering shareholders a “say-on-pay” is voluntary), mergers and acquisitions (M&A’s), transactions and restructuring, bylaw changes and routine items such as changing a company’s name.

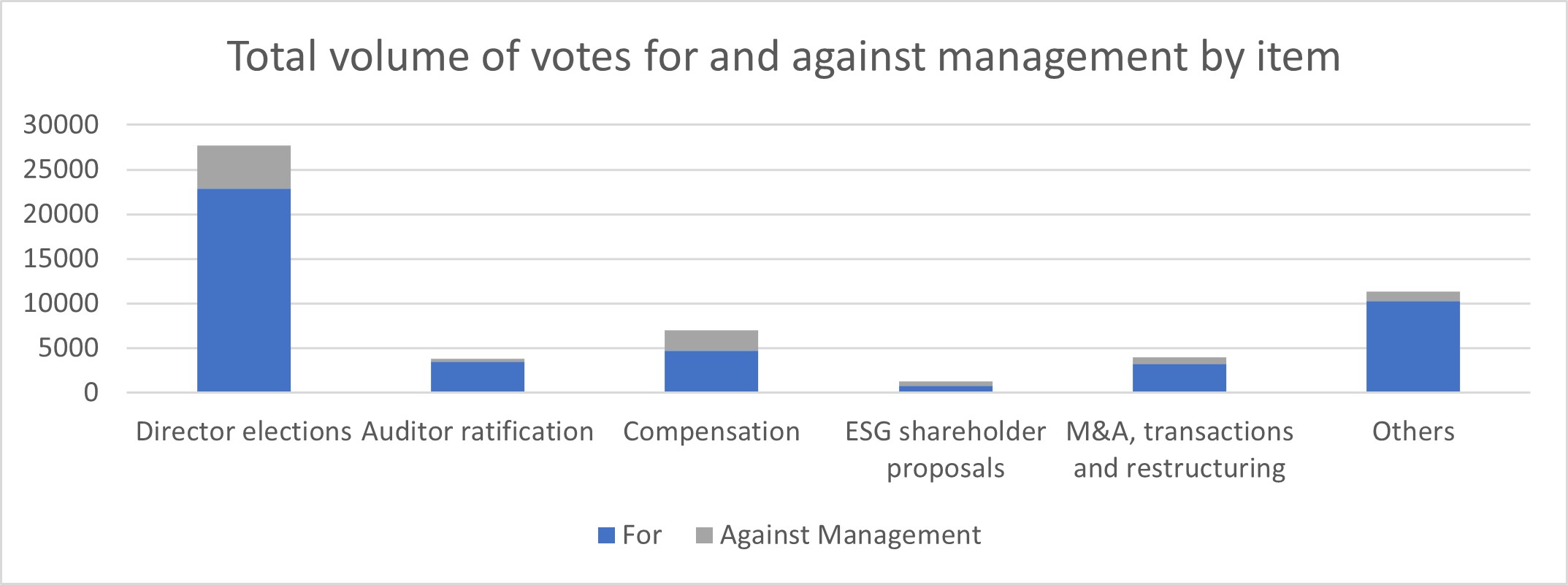

Figure 3 shows how our votes against management were distributed across ballot items and geographies. Given that the majority of items we typically get to vote on are directors, it is not surprising that director election items also constitute the majority of our votes against management.

Figure 3: Items where we voted against management in Canada, USA and globally. Source: BMO Global Asset Management, as of June 30th, 2023

Voting against directors for climate, deforestation, and human rights concerns

Where we have significant concerns about companies’ environmental or social practices, especially when they operate in high-risk sectors or countries, we have the ability to vote against directors on the board responsible for ESG risk management. Our voting partner reo© annually compiles lists of companies lagging on climate change, biodiversity, forced labour and human rights, using ESG data providers as well as publicly available benchmarking data from sources such as the Carbon Disclosure Project (CDP).

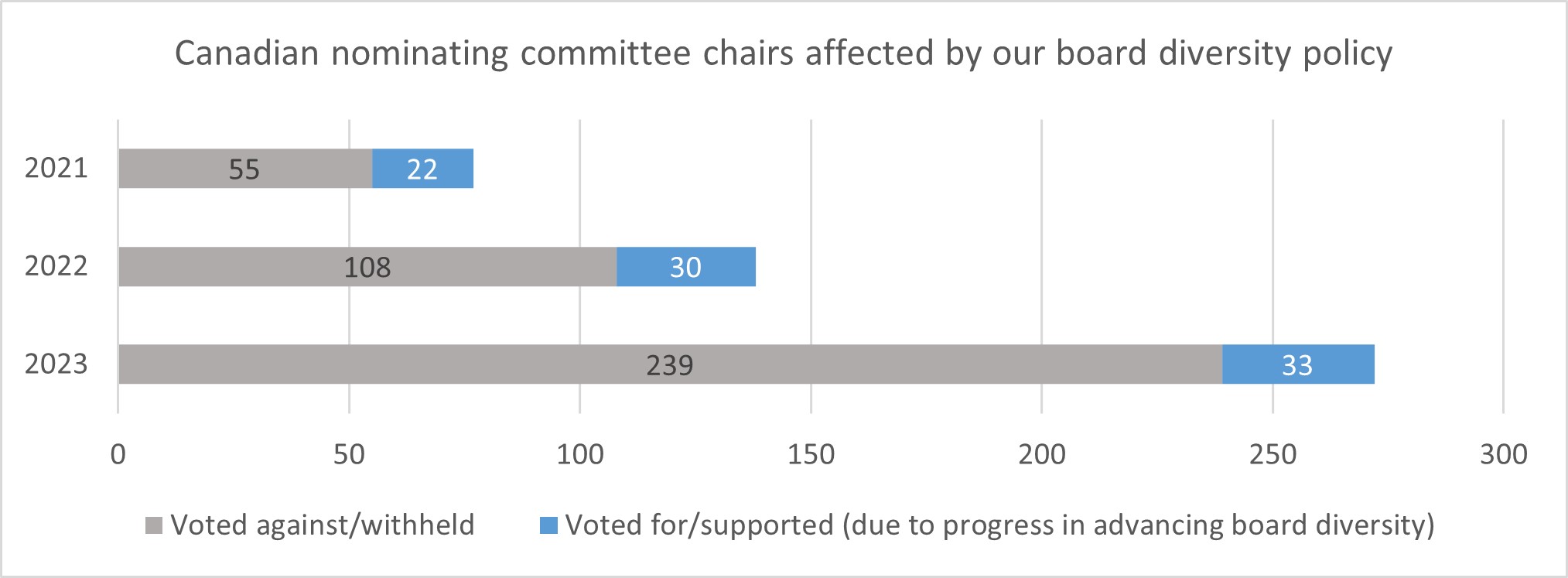

Continued progress on board diversity in Canada

In 2022 we raised our expectations on board diversity in Canada by increasing our minimum level of female representation on S&P/TSX boards from 25% to 30%, consistent with our commitment to the 30% Club Investor Group Canada. Additionally, we implemented a new voting guideline to withhold support from chairs of nominating committees in the absence of any racial diversity — unless the board conveyed meaningful plans, targets, and timelines to address the matter. This is consistent with our support of the Canadian Investor Statement on Diversity & Inclusion. Read more about our voting in 2022 here.

In 2023, we further enhanced our board diversity approach by requiring all Canadian TSX-listed companies to have at least 30% women on the board, beyond just the S&P/TSX. Because of this guideline change, our votes against nominating committee chairs more than doubled.

Figure 4: Votes against and in support of Canadian nominating committee chairs because of board diversity. Source: BMO Global Asset Management, as of June 30th, 2023

We are pleased to report that, while progress is still slow, overall, we have seen a marked uptick in both female and racially diverse director nominees this season.

Case studies

Board diversity at Stantec Inc. In 2022 we withheld support from the chair of the nominating committee at Stantec because of the absence of racial board diversity. While the company did have 33% female representation on the board and made significant progress on executive diversity, there was no robust target and timeframe to address progress on diversity beyond gender. We were pleased when in 2023 the company added two new female and racially diverse nominees to the board, bringing gender diversity to 50% and racial diversity to 20%. As such we were able to support the chair of the nominating committee in 2023.

Say-on-pay at Agnico Eagle We voted against the advisory vote on executive compensation (Say on Pay) at Agnico Eagle Mines due to problematic pay practices, including one-off high quantum cash bonuses awarded to the CEO and executive chair without pre-determined metrics and vesting conditions, and a 60% increase in total compensation cost for all Named Executive Officers. The former and now executive chair’s total compensation amounted to over CAD $20 million which far exceeded other metals and mining peer compensation. Although the company cited a successful merger with Kirkland Lake Gold as the reason for the payouts and committed to no longer award one-off bonuses in the future, the say-on-pay resolution failed for the second year in a row, with close to 75% of shareholders voting against. As the compensation committee chair’s nomination was removed from the ballot shortly before the AGM, vote results for this nominee are not known. This is only the second time in Canadian history that a company has lost two consecutive say-on-pay votes in a row.

Coal spin-off at Teck Resources Teck Resources asked for shareholder approval to separate the company into two independent entities: a producer of energy transition metals (“EVR”) and a steelmaking coal producer. We evaluated the spin-off of Teck’s coal producing business on 1) its ability to unlock value for shareholders and 2) what overall benefit it would bring to real-world climate outcomes. We considered several possible outcomes for and against the transaction and concluded that spin-off of the metallurgical coal assets would indeed unlock value and contribute to positive climate outcomes by enabling Teck to invest in and grow its copper business – a crucial resource for a successful energy transition. We did not find concerns related to potential privatization of the metallurgical (steelmaking) coal assets, given that several large public issuers showed interest in Teck’s assets. Unlike thermal coal production which should be phased out to meet Paris Agreement climate goals, there are not yet viable alternatives for steelmaking other than through metallurgical coal. Additionally, the transaction would have provided shareholders the ability to hold or sell EVR as a standalone entity. However, on the day of the AGM Teck withdrew the separation proposal citing that while “separation remains the best path to maximize value, [the company] will pursue a simpler and more direct separation approach.”5

Voting on (ESG) Shareholder Proposals

Trends of the 2023 season

Deciding our vote on ESG shareholder proposals

We will generally support E&S proposals that call on companies to improve their business strategy and public disclosures on managing material environmental and social risks in line with recognized international standards and frameworks. New and emerging proposals are assessed on a case-by-case basis. Elements we consider in our assessment:

- Does the shareholder proposal’s ask address a material or salient ESG issue for the company or a systemic risk for its industry?

- How does the shareholder proposal align with BMO GAM’s priority areas on Climate Action, Social Equality, and overall good governance?

- How is the company performing against peers?

- What is our precedence in supporting similar proposals in other or the same markets or sectors?

- Can the shareholder request be reasonably implemented?

What does abstain mean? In certain cases, we opt to vote “Abstain” on shareholder proposals where we agreed with the proponent’s intention but find the actual request overly prescriptive or not reasonably implementable. The decision to abstain relates to us abstaining on the topic, not on the vote itself (it still makes our vote count). Our vote rationale text explains why we chose to abstain. This is our attempt of bringing nuance into the generally binary nature of voting.

All ESG shareholder proposals received less support in 2023 than in the previous year. Average support for E&S proposals has fallen from 25% in 2022 to 19% this year, and for Corporate Governance related proposals from 35% to 28%. Average support for proposals calling for a reversal of ESG practices has fallen from around 2% to just above 1%11. Reasons for lower vote counts include a general increase in number of resolutions filed in 2023, proposals that are overly prescriptive which usually garner lower support, an influx of new or emerging requests which generally take some time to gather investor understanding and support, or cases where a company already implemented the requested changes.

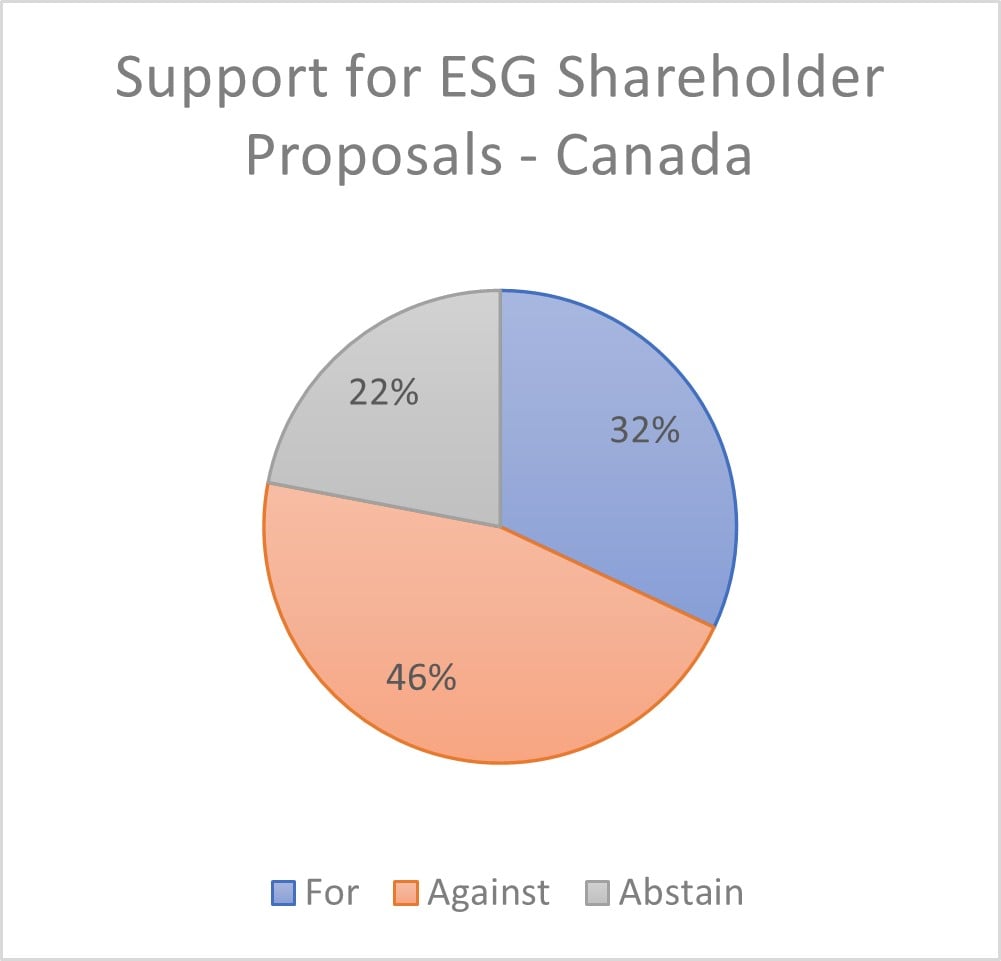

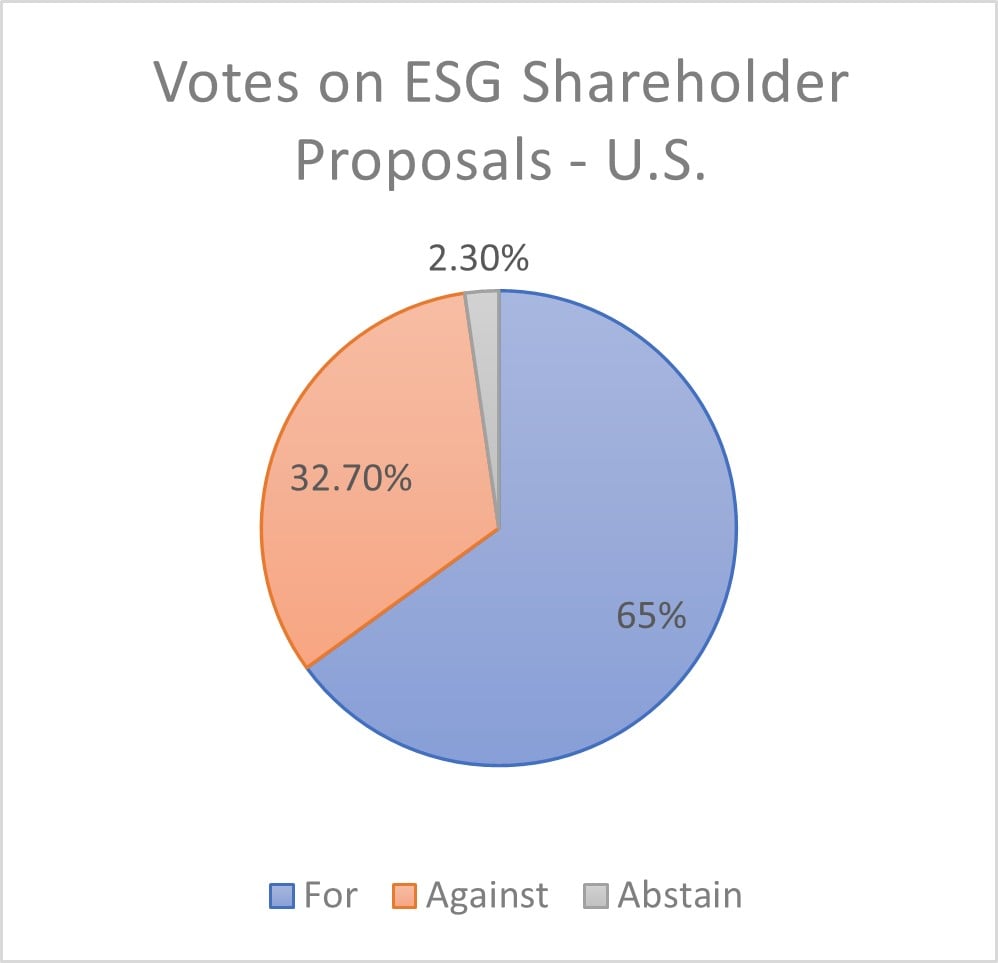

Our voting on ESG Shareholder Proposals in Canada and the U.S.

The U.S. is a much bigger market where filing shareholder proposals is considered more of a norm rather than a last-resort escalation mechanism (which is how Canadian institutional investors have traditionally approached the filing of shareholder proposals). In 2023 we voted on a total of 520 ESG shareholder proposals in the U.S. market. Overall, we supported 65% of shareholder proposals voted in the U.S. market, abstained from 2.3% and voted against 32.7% of proposals.

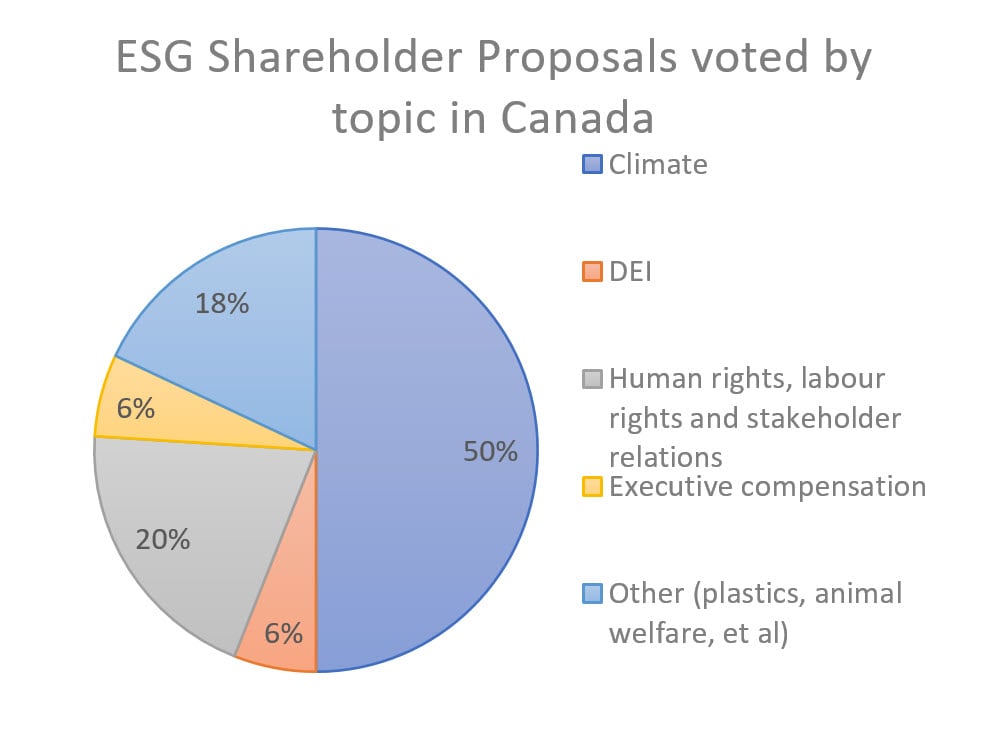

Figure 5 & 6: Percentage of ESG shareholder proposals voted For, Against and Abstain in Canada and the U.S., respectively. Source: BMO Global Asset Management, as of June 30th, 2023

The “other” resolution types included improved executive compensation practices such as claw-back provisions of incentive payments, shareholder rights such as proxy access and one-vote per share, as well as animal welfare, plastics and recycling and data security, internet, and privacy issues. This category represents the majority of the ESG shareholder proposal topics we voted on in the U.S., but we decided not to further break this down into subcategories to maintain comparability with the Canadian market.

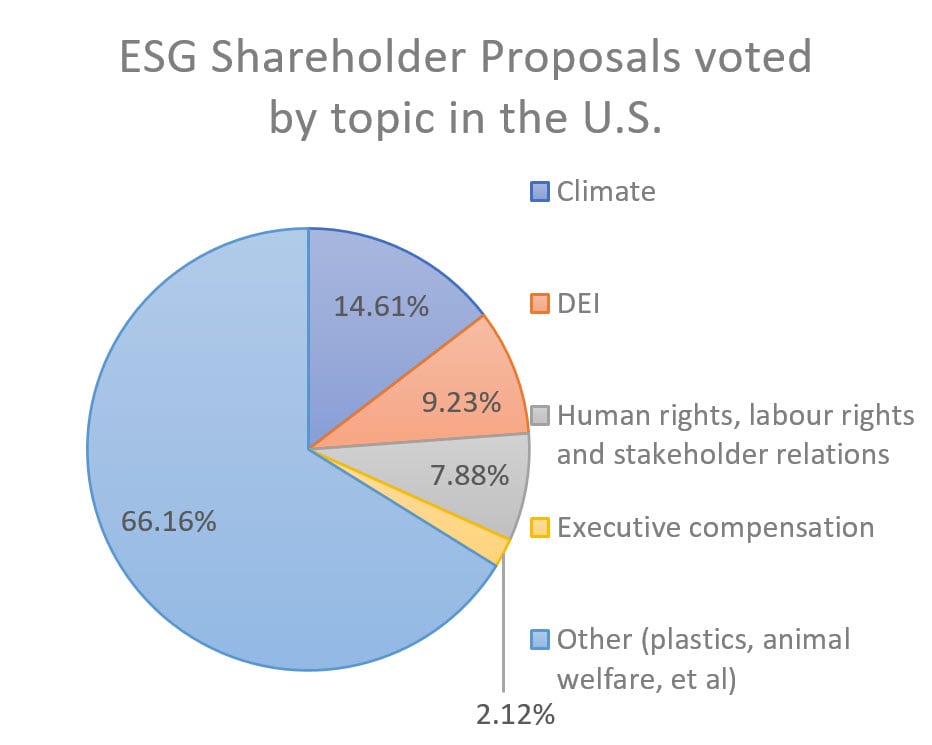

Figure 7 & 8: ESG shareholder proposals voted by topic voted in Canada and the U.S., respectively. Source: BMO Global Asset Management, as of June 30th, 2023

At BMO GAM we voted on 41 of such shareholder proposals, 38 in the U.S. and 3 in Canada, voting against all. 9 of the 38 such proposals in the U.S. were related to climate, and 28 related to DE&I and civil rights (for example – asking company to curtail racial equity and non-discrimination efforts and report on cost/benefit analysis of DEI&I programs). Climate-related proposals consisted sub-themes questioning the fiduciary relevance of the company’s decarbonization goal and asks to report on the risks of decarbonization. One shareholder proposal asked the company (Eli Lilly and Company) to avoid support of abortion-related activities. This proposal is discussed in the case studies section below.

Case studies

Approve Recapitalization Plan for all Stock to Have One-vote per Share. We supported a shareholder proposal filed at Alphabet Inc. requesting the company’s board to take steps to adopt a recapitalization plan for all outstanding stock to have one vote per share, and to do so within a timeframe justified by the board. Because of its multi-class voting structure, over 50% of the company’s outstanding voting powers have consistently been held by the company’s two co-founders while they owned 12% of the stock. This has raised concerns that interests of “public shareholders” may be subordinate to those of the company co-founders which could have an adverse impact on unaffiliated shareholders. The fact that similar proposals requesting phase-out of the multi-class voting structure have been filed at Alphabet every year since 2012 is testament to shareholder concerns on the subject. This year, the proposal received just over 30% shareholder support, consistent with outcomes in recent years and up from 17.7% since a similar proposal was first filed at the company in 2012. One vote, one share is a fundamental element of good corporate governance and as also stated in our Corporate Governance Guidelines, we favour a share structure that gives all shares equal voting rights and encourage companies to take steps to eliminate differential voting structures over time.

Access to reproductive rights and maternal healthcare: Meta Platforms, Inc. and Eli Lilly and Co. In June 2022 the U.S. Supreme Court struck down nearly 50 years of abortion rights. The after-effects of this verdict spilled over into the shareholder activism space with proponents filing over 20 shareholder proposals seeking protection of right of access to abortion and maternal healthcare. We voted in favour of one such proposal at Meta Platforms Inc. asking the company to assess and report the feasibility of expanding consumer privacy protections and controls over sensitive personal Meta user data in order to diminish the targeting of abortion-related law enforcement requests. In 2022 Meta satisfied a Nebraska police warrant demanding access to Facebook messages from a mother facing felony charges for allegedly helping her daughter terminate a pregnancy. Whilst Meta has a legal obligation to comply with lawful data requests, it can do more to protect individual user privacy and protection. The proposal secured 10% of the preliminary vote. On the other hand, a shareholder proposal at Eli Lilly and Company asked the company to report on the risks of its opposition to regulation restricting abortion, and how it plans to mitigate these risks. The proponent cited instances where Lilly opposed an Indiana law which restricted abortion access and that in response the company expanded its employee health plan to include coverage for travel for abortion. We voted against this proposal which received 1.8% shareholder votes in favour.

Change-in-control severance agreements. We supported 31 shareholder proposals at U.S. companies asking for the board to implement stronger change-in-control severance agreements. These are agreements that set out in advance the maximum amount of severance payout executives would receive if they were forced out by a merger or another reason without cause for dismissal. From our perspective, such payments should not exceed two years pay and any larger severance packages should be subject to separate shareholder approval to ensure it is in line with shareholder interests. Change-in-control severance agreements are part of our analysis of executive compensation structures and can contribute to us voting against a say-on-pay vote if not in line with our expectations. A subset of the proposals we supported at Health Care companies specifically, cited concern over increasing CEO compensation during a time where opioid-related litigation and settlements turned a financial loss in 2020 into an adjusted profit yielding CEO payouts they would otherwise not have qualified for. Given both the broader societal impacts of the opioid crisis in North America as well as the principle that executives should be awarded compensation based on actual performance, we did not deem this to be prudent compensation design.

Looking ahead

1 We define the 2023 proxy voting season as the period from January 1st – June 30th, 2023

3 Ibidem

4 Our Corporate Governance Guidelines can be found here: https://www.bmogam.com/uploads/2023/05/f4507ac8981ea83707d9c4d5e63cf2c3/corporate_governance_guidelines_en.pdf

6 https://www.kiplinger.com/investing/netflix-shareholders-reject-proposed-executive-pay-package

7 https://www.nasdaq.com/articles/proxy-season-update-for-2023%3A-what-shareholders-are-saying

8 2023 Proxy Statement, Netflix, Inc.

9 https://corpgov.law.harvard.edu/2023/06/01/2023-proxy-season-more-proposals-lower-support/

10 ISS, 2023 Canada Proxy Season Preview, April 2023

11 https://www.nasdaq.com/articles/proxy-season-update-for-2023%3A-what-shareholders-are-saying

14 https://www.proxypreview.org/2023/report

15 ISS, 2023 Canada Proxy Season Preview, April 2023

16 https://www.cenovus.com/Sustainability/Environment/Climate-and-GHG-emissions

17 https://www.cenovus.com/News-and-Stories/News-releases/2021/2244215

18 https://share.ca/wp-content/uploads/2022/09/SHARE_Pulling-back-the-curtain-2022-EN.pdf

19 https://lobbymap.org/company/Cenovus-Energy

20 https://services.google.com/fh/files/blogs/bsr-google-cr-api-hria-executive-summary.pdf

21 https://abc.xyz/investor/static/pdf/2021_alphabet_annual_report.pdf?cache=3a96f54

22 https://ec.europa.eu/commission/presscorner/detail/en/ip_22_6423; https://www.europarl.europa.eu/news/en/press-room/20220412IPR27111/digital-services-act-agreement-for-a-transparent-and-safe-online-environment

23 https://documents-dds-ny.un.org/doc/UNDOC/GEN/N06/512/07/PDF/N0651207.pdf?OpenElement

24 https://www.canlii.org/en/ca/laws/stat/sc-2021-c-14/latest/sc-2021-c-14.html

25 https://www.pewtrusts.org/-/media/assets/2020/07/breakingtheplasticwave_report.pdf

26 https://www.packworld.com/news/sustainability/article/22419036/four-states-enact-packaging-epr-laws

29 https://www.unep.org/about-un-environment/inc-plastic-pollution

30 Proxy circular, Restaurant Brands International, Inc., 2023

31 https://www.theguardian.com/business/2022/jul/04/new-york-starbucks-closed-union-drive

32 https://www.nytimes.com/2022/08/25/business/economy/starbucks-union-howard-schultz-nlrb.html

Disclaimers:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements.

These are not recommendations to buy or sell any particular security.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management, are designed specifically for various categories of investors in Canada and may not be available to all investors. Products and services are only offered to investors in Canada in accordance with applicable laws and regulatory requirements.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.