- Home

- Investment products

- Alternative Investments

- BMO Carlyle Private Equity

BMO Carlyle private equity strategy partnership

Why private equity?

BMO Carlyle private equity strategy

About Carlyle

Carlyle (NASDAQ: CG) is a global investment firm with deep industry expertise that deploys private capital across three business segments: Global Private Equity, Global Credit and Global Investment Solutions (“AlpInvest”). With $426 billion of assets under management (AUM) as of December 31, 2023, Carlyle’s purpose is to invest wisely and create value on behalf of its investors, portfolio companies and the communities in which we live and invest. Carlyle employs more than 2,200 people in 28 offices across four continents.

1987

US$161Bn AUM

1999

US$188Bn AUM

2011

US$77Bn AUM

Meet the BMO Global Asset Management Alternatives Team

Adam Abitbol, CIM

Adam has been in the finance industry since 2006. He joined the team at BMO Global Asset Management in 2017 and served as a specialist for our SMA platform at BMO Nesbitt Burns. His team was tasked with fund raising for BMO GAM’s first series of Alternatives products. Prior to joining BMO, Adam held a number of sales-related roles at other financial institutions in multiple sectors of the industry. Adam brings with him knowledge of damage and personal lines insurance, options trading strategies, SMAs, mutual funds, seg funds, hedge funds and private equity fundraising. Adam is a Chartered Investment Manager (CIM).

Natalie Camara

Natalie is responsible for growing BMO Global Asset Management’s Institutional presence in Western Canada, levering multi-channel expertise, a keen focus on relationship management and a deep understanding of industry dynamics. Drawing on over two decades of financial services experience, Natalie is focused on aligning capabilities with investor needs, to effectively help clients reach their unique objectives. Prior to joining BMO Global Asset Management in 2015, Natalie worked for major investment management firms in progressively senior roles, specializing in investment product marketing, business development, and sales and relationship management. She graduated with a Bachelor of Arts degree from the University of Manitoba, and holds the Chartered Investment Manager (CIM) designation.

Jeffrey Shell

Jeff joined BMO Global Asset Management in August of 2021 from BMO Capital Markets, where he served as head of Global Financial Institutions, with responsibilities that included serving Asset and Wealth managers. Previous to this, Jeff had a number of leadership roles at BMO including heading Trade Finance, Treasury & Payments Solutions and Asia Corporate Banking, in addition to serving as an advisor in Corporate Strategy. Prior to BMO, Jeff worked as a strategy consultant, as a university researcher and as an entrepreneur. He has authored a number of patents related to advanced technology interface design. He holds a Master’s degree in Computer Science from Queen’s University and an MBA from Cornell University.

Lillian Ferndriger, CAIA

Lillian joined BMO Global Asset Management having spent the last 15 years in wealth management at various firms in sales, sales management and National Accounts. Her most recent experience was with a Canadian alternatives manager to help educate and foster a passion for alternatives investing. Lillian has deep experience and demonstrated success in the Canadian alternatives space and is a member of the AIMA Canada Executive Committee.

Alexander Singh

Alex is in a leadership role focused on alternatives partnerships and merchant banking activities across BMO Wealth and BMO Global Asset Management. Alex’s career has spanned alternatives and impact investing, including many years building and scaling independent alternatives asset managers and merchant banks including Acasta and West Face Capital. He was also an investment banker, and began his career as a banking/bankruptcy and securities/M&A lawyer at BLG LLP. He holds a BComm from McGill University, and a Juris Doctor (JD) degree from Dalhousie University.

For general enquiries

Please contact [email protected]

Sources

Footnotes

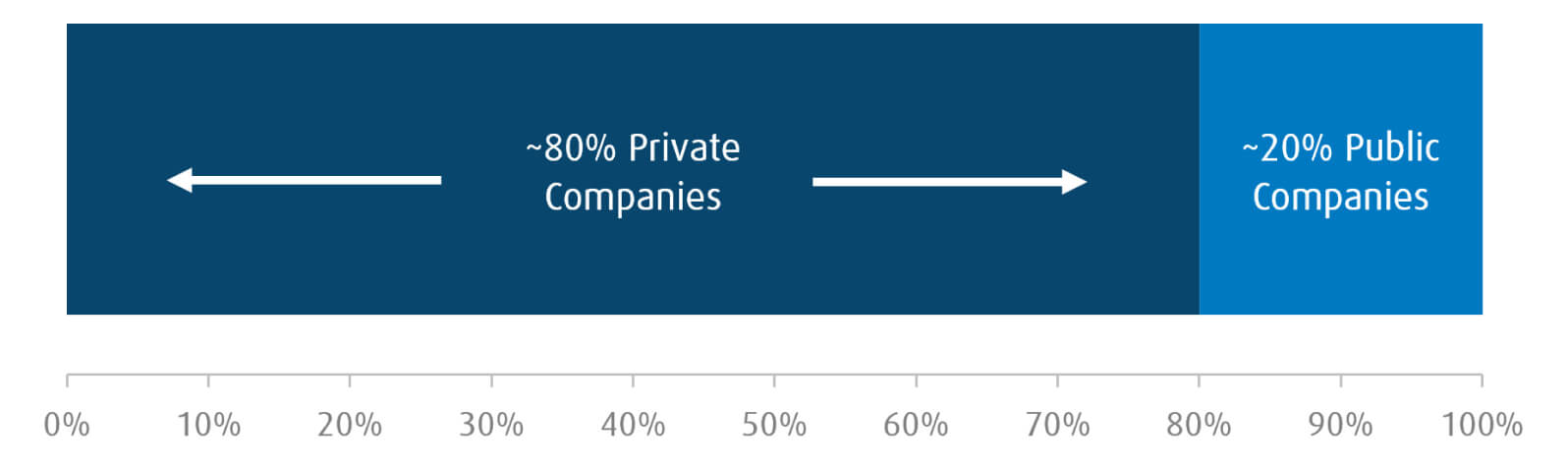

1 S&P Capital IQ, December 2022; Statistics of US Businesses; Bain & Company analysis. ↩

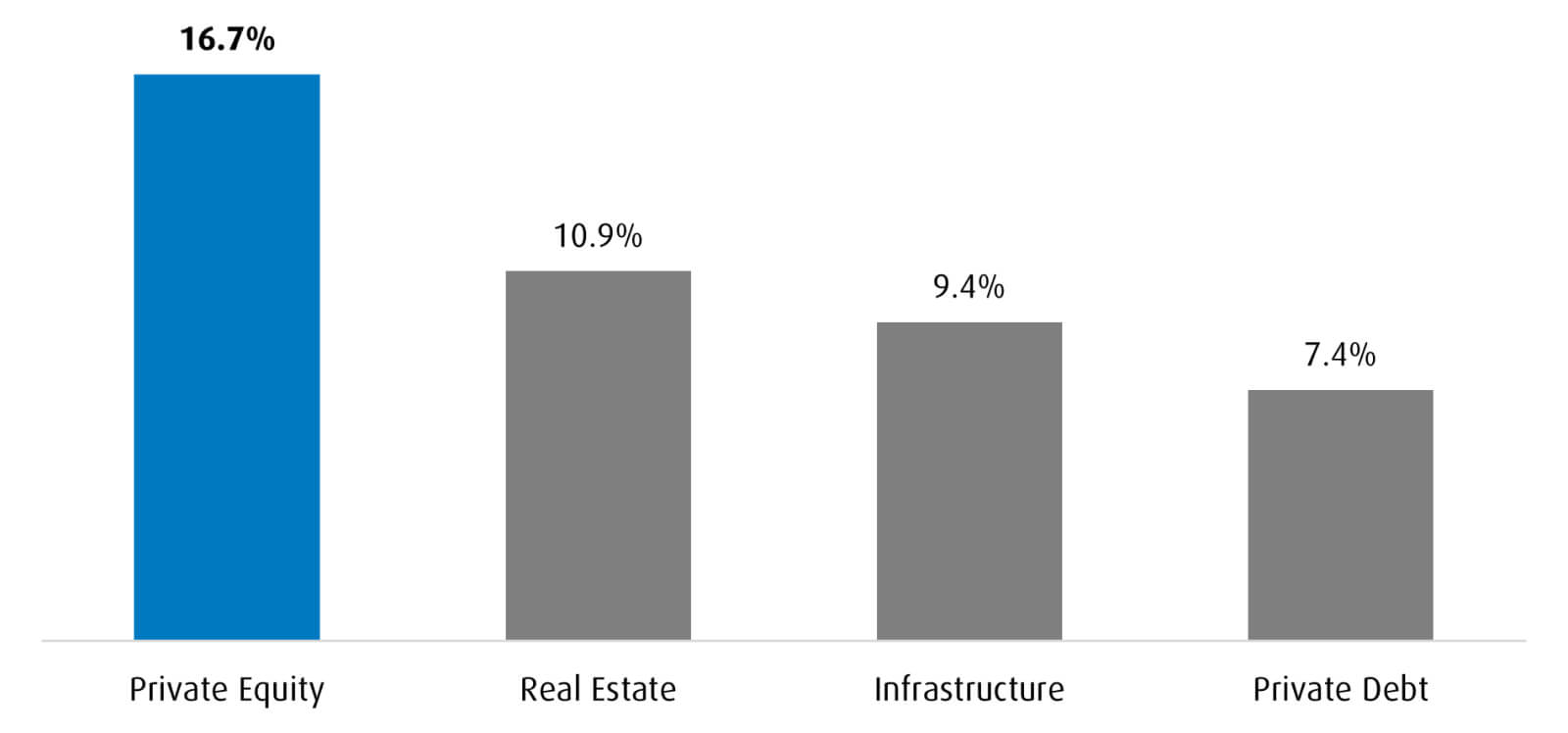

2 Preqin – 10 year horizon IRR’s benchmarks for the period ending Q2 2023 ↩

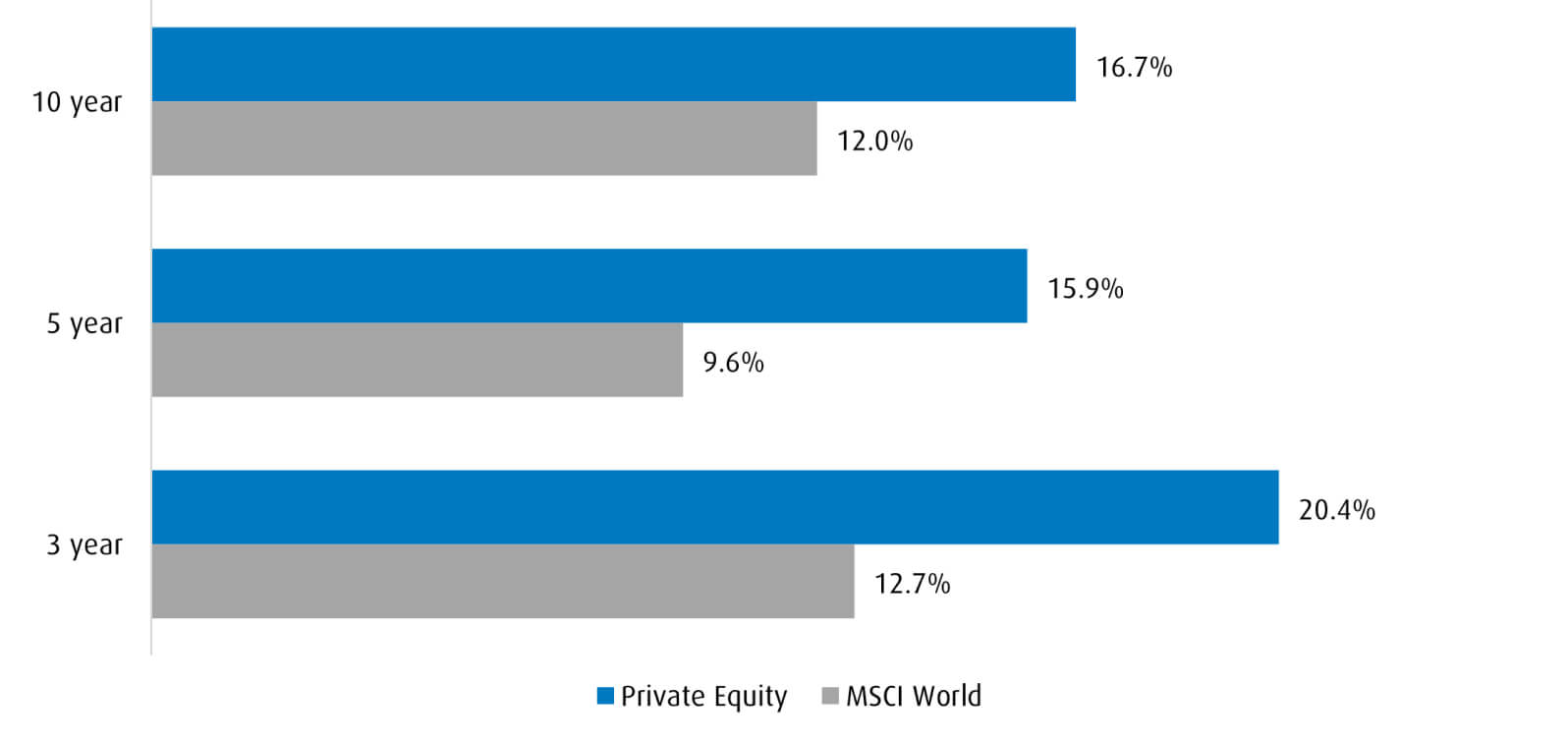

3 Preqin – Private Capital Quarterly Index, June 30, 2023. ↩

4 Forbes – by Assets Under Management (AUM) incl. Global Credit business segment, December 1st, 2023 ↩

Disclosures

The information provided is for informational purposes only. Under no circumstances is this document to be construed as an offer to sell securities or the provision of advice in relation to any securities. Any offer or sale of any securities referenced in this document will be made pursuant to a confidential offering memorandum or similar document to eligible investors who qualify as “accredited investors” under applicable Canadian securities laws. The strategy described herein is not intended for investors outside of Canada. In addition, any offer or sale of, or advice related to, any securities referenced in this document will be made only by a dealer registered in the appropriate category or relying on an exemption from registration. No Canadian securities regulatory authority has reviewed or in any way passed upon the information contained in this document or the merits of any securities referenced in this document, and any representation to the contrary is an offence.

Statements that depend on future events are forward-looking statements. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties, and assumptions. These statements may be based on assumptions that are believed to be reasonable, however there is no assurance that actual results may not differ materially from expectations. Investors should not rely solely on forward-looking statements and should carefully consider the areas of risk described in relevant offering documents.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain products and services offered under the brand name, BMO Global Asset Management, are designed for specific categories of investors in Canada and may not be available to all investors. Products and services are only offered to investors in Canada in accordance with applicable laws and regulatory requirements.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.