Alternative Investments

Making alternative investments accessible for Canadian accredited investors.

What are alternative investments

Alternatives generally include assets that are either not traded publicly or a method of investing using non-traditional strategies. This broad category includes two specific areas of emphasis for BMO Global Asset Management – private markets and hedge funds.

Alternatives have long been a meaningful component of institutional, family office and ultra-high net worth investors’ portfolios. These investors allocate a significant portion of their portfolios to alternatives because they have historically improved risk-adjusted performance.

BMO Global Asset Management is focused on developing solutions that make private markets and hedge funds more accessible for Canadian accredited investors.

Alternative funds

BMO GAM offers both evergreen and closed-end funds for Canadian accredited investors through offering memorandums:

BMO Partners Group Private Markets Fund*

(open-ended fund)

Provides access to globally diversified private markets in a single ticket for Canadian accredited investors

BMO First Canadian Capital Partners II

(close-ended fund)

BMO Carlyle Private Equity Strategies Fund

(open-ended fund)

This fund provides access to globally diversified private equity in a single ticket for Canadian accredited investors.

BMO Georgian Alignment II Access Fund LP **

(close-ended fund)

Provides access to the Georgian Alignment Fund II, a concentrated growth equity fund invested in hand-picked software companies for Canadian accredited investors

Portfolio benefits

Alternatives can play a complementary role to the stocks and bonds within a traditional portfolio. Key benefits include:

Enhanced returns

Investments like Private Equity, on average, generate higher returns than public market equivalents. These investments may also carry more risk than their public market equivalents.

Generate income

Investments like Private Credit and Real Assets can produce stable, floating rate income.

Diversify risk

Diversified Private Markets and Hedge Funds can provide outcomes with limited connection to public markets that may increase the consistency of the overall portfolio returns.

Types of alternatives

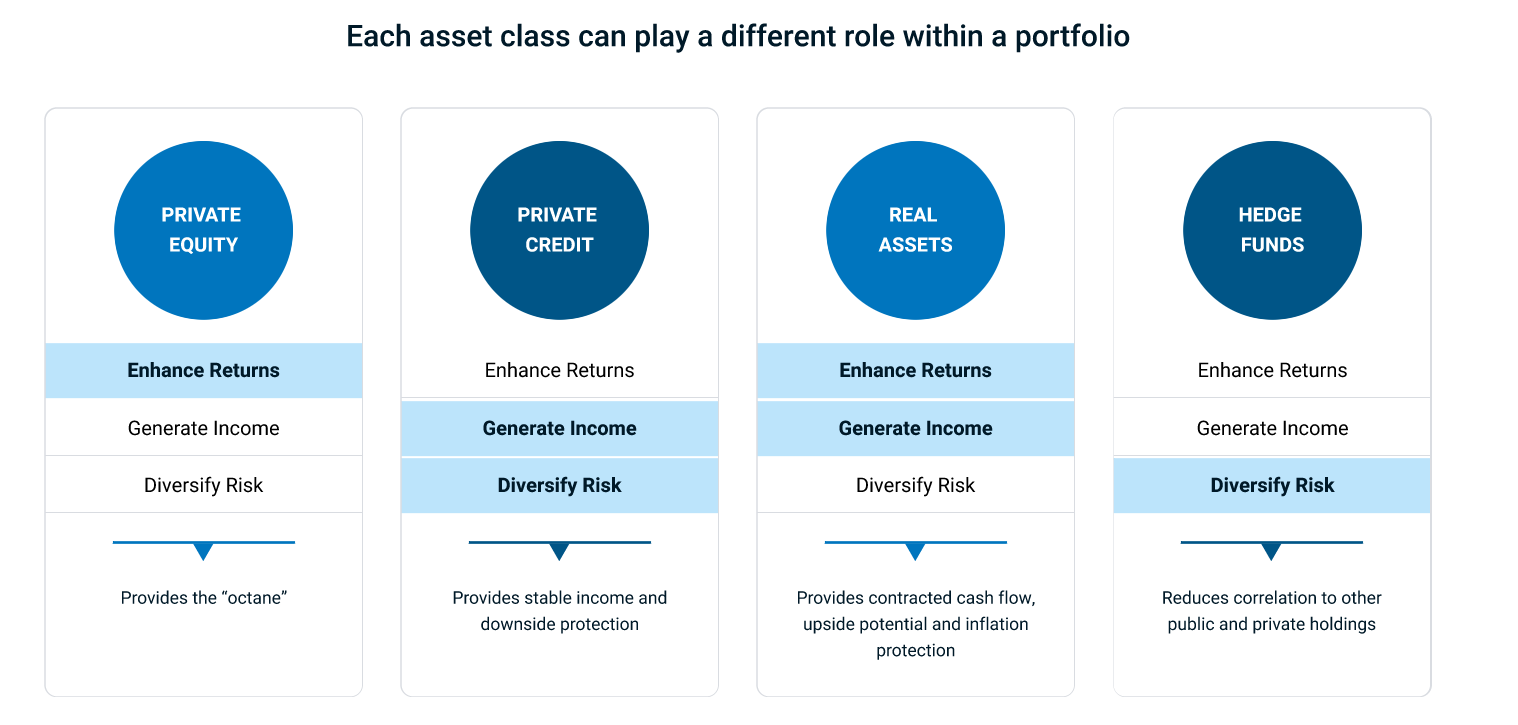

Alternatives, just like public markets, refers to a variety of individual investment types. BMO’s focus within Alternatives is private markets – including equity, credit and real assets like real estate and infrastructure – and hedge funds.

Alternatives can be further described by region, sectors and other factors. For example, private equity includes venture capital or buyout investments, to name just two. Private credit can cover performing loans or distressed loans. And just like with traditional public market investments, each Alternative asset class is responsible for delivering a specific benefit to your portfolio.

Our approach

BMO Global Asset Management uses two approaches to provide access to alternatives for Canadians accredited investors.

Create proprietary products

Where we have expertise and a demonstrated track record, we develop in-house solutions.

Find the best managers

Where we don’t have proprietary products, we take a research-first approach to identify strong global managers, and partner with them to fit the needs of Canadian accredited investors.

Meet the team

Natalie Camara

Natalie is responsible for growing BMO Global Asset Management’s Institutional presence in Western Canada, levering multi-channel expertise, a keen focus on relationship management and a deep understanding of industry dynamics. Drawing on over two decades of financial services experience, Natalie is focused on aligning capabilities with investor needs, to effectively help clients reach their unique objectives. Prior to joining BMO Global Asset Management in 2015, Natalie worked for major investment management firms in progressively senior roles, specializing in investment product marketing, business development, and sales and relationship management. She graduated with a Bachelor of Arts degree from the University of Manitoba, and holds the Chartered Investment Manager (CIM) designation.

Jeffrey Shell

Jeff joined BMO Global Asset Management in August of 2021 from BMO Capital Markets, where he served as head of Global Financial Institutions, with responsibilities that included serving Asset and Wealth managers. Previous to this, Jeff had a number of leadership roles at BMO including heading Trade Finance, Treasury & Payments Solutions and Asia Corporate Banking, in addition to serving as an advisor in Corporate Strategy. Prior to BMO, Jeff worked as a strategy consultant, as a university researcher and as an entrepreneur. He has authored a number of patents related to advanced technology interface design. He holds a Master’s degree in Computer Science from Queen’s University and an MBA from Cornell University.

Lillian Ferndriger, CAIA

Lillian joined BMO Global Asset Management having spent the last 15 years in wealth management at various firms in sales, sales management and National Accounts. Her most recent experience was with a Canadian alternatives manager to help educate and foster a passion for alternatives investing. Lillian has deep experience and demonstrated success in the Canadian alternatives space and is a member of the AIMA Canada Executive Committee.

Alexander Singh

Alex is in a leadership role focused on alternatives partnerships and merchant banking activities across BMO Wealth and BMO Global Asset Management. Alex’s career has spanned alternatives and impact investing, including many years building and scaling independent alternatives asset managers and merchant banks including Acasta and West Face Capital. He was also an investment banker, and began his career as a banking/bankruptcy and securities/M&A lawyer at BLG LLP. He holds a BComm from McGill University, and a Juris Doctor (JD) degree from Dalhousie University.

Iain Munro, MBA, B.Sc.

Iain Munro serves as Head of Private Equity, North America at BMO Global Asset Management (“BMO GAM”). Iain has more than 25 years of experience delivering advice and solutions to private equity groups and middle market companies throughout Canada and the U.S. as a principal investor and investment banker. Iain’s disciplined approach to investing has been developed through his experience operating within leading Canadian financial institutions with strong risk management cultures and stringent regulatory and compliance requirements. Iain joined BMO GAM’s Private Equity team in 2018 to expand its platform to North America. Prior to joining BMO, Iain held various senior leadership roles at two Canadian financial institutions, including Managing Director & Head of North American Private Equity Coverage. In this position, Iain led high performing teams based in Chicago, Charlotte and Toronto providing junior capital solutions to Canadian and U.S. private equity groups, primary fund investments and equity co-investments. Iain is active in the community. He is a member of the Canadian Venture Capital and Private Equity Association, a past-member of the Association for Corporate Growth and is a current and past member of the Board of Directors and Advisory Committees of several private companies. Iain earned an MBA from the University of Toronto and a B.Sc. from the University of Western Ontario.

Mark Jarosz

Mark serves as lead for Private Credit investments. Mark brings over 15 years’ experience in originating, structuring and advising across credit assets. He has worked with a large Canadian pension fund focused on leveraged loans, as well as a boutique structured credit shop. He holds a B.A (Hons) in Economics and Commerce and a postgraduate degree in Quantitative Finance (Wilmott/NYU).

Graham Partner, CFA, FRM

Graham Partner is a financial services professional with a broad background across asset management, capital markets and treasury environments for global financial institutions. Currently, he has responsibility over strategic initiatives for alternative investment products at BMO Global Asset Management

Jayme Kruger

Jayme’s career has focused on commercial real estate investments across the capital stack in both public and private markets. Prior to joining BMO Global Asset Management (BMO GAM), Jayme launched a real estate private equity investment vehicle focused on specialized equity and debt solutions along with select real estate development projects. Jayme’s career in the public markets has focused on the REIT sector, most recently VP, Investments at Crombie REIT, responsible for strategy, capital markets, and transactions across the organization.

Jim Eplett

Jim has over 35 years of Canadian commercial real estate experience spanning both lending and asset management, credit structuring, commercial mortgage underwriting and evaluating the properties and markets underlying CRE loans. He has navigated several commercial real estate cycles with direct involvement in over $20 billion of mortgage originations and $4 billion of property transactions. Prior to joining BMO in 2006, Jim held multiple positions in both commercial real estate credit and equity at Merrill Lynch Mortgages, MetLife Real Estate Investment, GE Capital Real Estate and Knowlton Realty Ltd. He holds an Honours Business Administration (HBA) from Ivey Business School in London, Ontario.

Ben Abadi, MBA, M.S

Ben Abadi has responsibility for co-managing the Impact Investment Fund. The C$350 million Impact Investment Fund is aimed at driving more sustainable outcomes around the world by backing technologies that will help BMO and its clients proactively address sustainability and create positive impact for their stakeholders. Prior to joining BMO, Ben was in deal lead roles at Emerald Technology Ventures and at Energy Innovation Capital, and previously spent a decade as a late-stage private equity investor. Ben’s investment experience spans more than two dozen private companies, 20 boards as a director or observer, 60 closed transactions and $20 billion of completed transaction value. Ben holds an MBA from Harvard Business School and a M.S. and B.A. from Stanford University.

Marc Khouzami, MBA

Marc Khouzami has responsibility for co-managing the Impact Investment Fund. The C$350 million Impact Investment Fund is aimed at driving more sustainable outcomes around the world by backing technologies that will help BMO and its clients proactively address sustainability and create positive impact for their stakeholders. Prior to joining BMO, Marc spent over 11 years in Deutsche Bank’s Asset Management group, serving as a generalist private equity investor focused on sustainability covering a variety of sectors. Additionally, Marc developed and executed financial products to help corporate clients achieve their sustainability goals. Prior to joining Deutsche Bank in 2009, Marc was at Citi Alternative Investments, where he was responsible for making growth equity investments as part of the Sustainable Development Investments group. Before joining Citi Alternative Investments, Marc held various roles in investment banking and corporate finance at Paragon Capital Partners, Oxygen Media and Lehman Brothers. Marc spent 12 years on the board of directors of Change Machine, a non-profit organization that uses its platform technology to assist the working poor in the United States achieve financial security, most recently as the chair. Marc currently serves on the board of NYCEEC, a non-profit organization that is dedicated to financing hard to finance energy efficiency projects in the built environment. Marc holds a bachelor’s degree in mathematics and economics from Vanderbilt University and a MBA from Columbia Business School.

ALTitude™ Your quarterly guide to the world of alternative investing

Pure private equity, simplified

The savvy investor’s guide to secondaries

New opportunities in private credit, powered by BMO GAM

Bridging the “Alternatives Gap”

The Evergreen Solution

Introducing Altitude

Alternative investments FAQs

“Public markets” is a collective term for assets which are traded on public exchanges – such as stocks on public stock markets and bonds on bond exchanges.

“Private markets” is a collective term for private assets, including private equity, private credit, and private real assets like real estate and infrastructure. Private assets are not traded on public exchanges, requiring buyers and sellers to come to a mutual understanding of price before a transaction can occur.

- Private Equity: An investment in a privately held company to generate value with the end goal of exiting through an Initial Public Offering (IPO), merger, or sale.

- Private Debt: Providing loans directly to companies in privately negotiated transactions or acquiring these loans on the secondary market.

- Real Estate: A type of ‘real asset’ investment that includes the acquisition, financing, and ownership of physical properties or privately held companies that own, operate, or develop properties.

- Infrastructure: A type of ‘real asset’ investment that includes the acquisition, financing, and ownership physical assets or privately held companies that provide essential services to society, such as transportation, energy, or sewage.

A fund that has a fixed number of shares that are issued at inception and are not redeemable until the fund’s termination. These funds typically have a limited life with three phases: a fundraising period, investment period, and wind-down period.

An evergreen fund has no fixed termination date and can continuously raise and invest capital. When a sale is made in the fund, the cash is reinvested into new investments rather than returned to investors.

Yes, just like public or listed equity has different sectors and styles, so does private equity. These include, but are not limited to:

- Venture capital – Investments in early-stage companies that need capital for research & development and growth. These are new companies with unproven products that have the potential to be transformative.

- Growth Equity – Investments in maturing companies with existing revenues but in need of capital to expand. Companies will typically use the capital to facilitate growth and expansion of operations, assist team in transition, or finance a transforming event.

- Buyout – Investments in mature companies, typically with stable cash flows; investors typically acquire a controlling stake in an existing company, either by purchasing all or most of its shares or assets.

- Core investment – A low-risk, low-return strategy that focuses on acquiring stable, high-quality assets with long-term leases/contracts and credit-worthy tenants/counterparties (e.g., Buy & Hold). Core investments provide investors with yield and modest capital appreciation; target returns typically range from 6-9%.

- Core plus – A low-to-moderate risk/return strategy that involves slightly lower quality assets than core, with some potential for value enhancement through renovations, repositioning, or increased occupancy (e.g., Buy → Improve → Hold). Core plus investors typically use moderate leverage (30% to 50%); target returns typically range from 9% to 13%.

- Value-Add – This is a moderate-to-high risk/return strategy that involves acquiring assets in need of significant improvements, and then increasing their value through active management, capital expenditures, or operational efficiencies (Buy → Fix → Sell). If the Value-Add investor is successful, the asset is typically de-risked and sold to a core investor on exit. Value-add investors typically use high leverage (up to 80%); target returns typically range from 13% to 15%.

- Opportunistic – This is a high-risk, high-return strategy that involves investing in distressed, undervalued, or niche assets that require extensive redevelopment, repositioning, or conversion (e.g., Buy→Fix→Sell). If an Opportunistic investor is successful, the asset is typically de-risked and sold to a core investor on exit. Opportunistic investors typically use very high leverage (up to 90%); target returns are typically 20%+.

Disclaimers

Commissions, management fees and expenses (if applicable) may be associated with investments in mutual funds and exchange traded funds (ETFs). Trailing commissions may be associated with investments in mutual funds. Please read the fund facts, ETF Facts or prospectus of the relevant mutual fund or ETF before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in BMO Mutual Funds or BMO ETFs, please see the specific risks set out in the prospectus of the relevant mutual fund or ETF. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Mutual Funds are offered by BMO Investments Inc., a financial services firm and separate entity from Bank of Montreal. BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.