Summary:

- Fixed-income investors are enduring a historical drawdown that began in August 2020, but we think they should refresh their perspective on the asset class as we head into 2024.

- Yes, cash-yields look attractive, but the scope for rate cuts through 2025 looks even more attractive. Central banks don’t need a recession to start easing in the next year, but a recession would mean even greater upside for bonds.

- History shows that fixed income tends to outperform both cash and equities when the Fed is done hiking interest rates, thereby contributing positively to diversify long-term portfolios. Moreover, we think bonds can act as a hedge to equity drawdowns going forward.

Fixed-income investors have endured a painful performance since August 2020 when the yield on US 10-year Treasury yield touched its record low of 0.51%. After over three years of drawdowns, many investors are left with a sour perspective on fixed-income assets and look to cash for peace of mind. While the lure of high cash yields can seem attractive, we think investors should not lose sight of the broader investment landscape and consider strategically redeploying cash balances toward fixed income heading into 2024.

With the U.S. Federal Reserve and Bank of Canada nearing the end of their intense monetary-policy tightening campaign to curb inflation, the risk of futher material increases in interest rates has greatly diminished. Even though labour markets remain tight currently, high interest rates will increasingly weigh on spending among consumers and businesses, which will ultimately feed through to looser labor market conditions. The Canadian economy is already showing signs of strains in the consumer and housing markets, further reinforcing the view that monetary policy is tight and weiging on economic activity, which should ultimately continue to ease inflation.

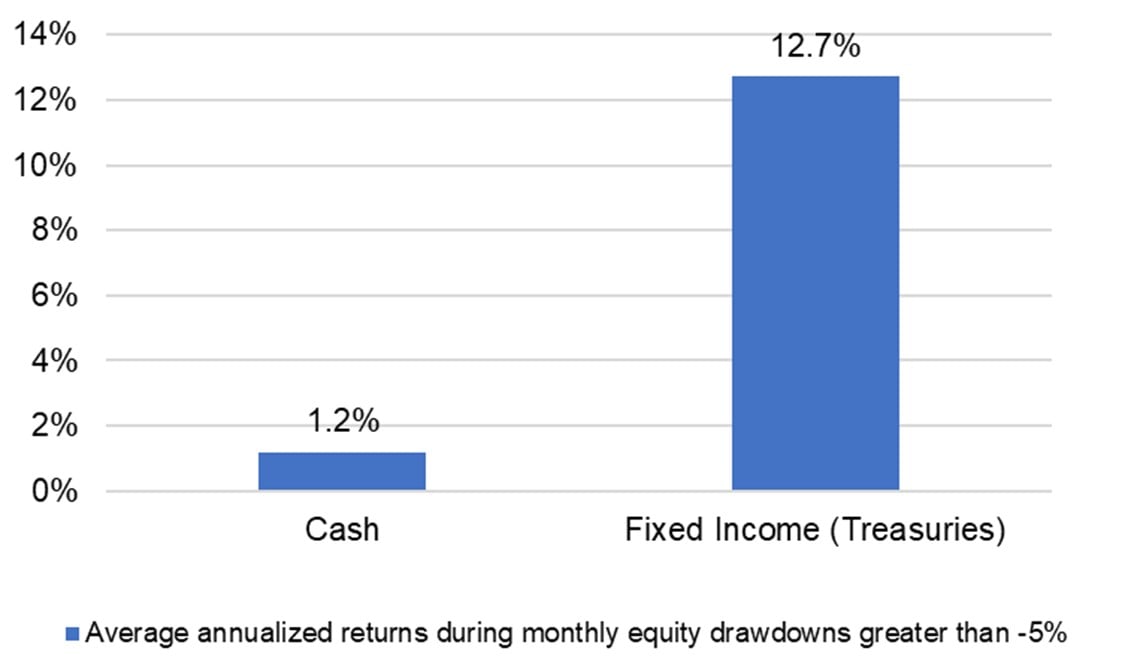

With this outlook, we think bonds are back and have scope to ouperform cash into 2025. We illustrate our historical analysis using U.S. data on 3-month Treasury bills, Treasury notes and bonds, and the S&P 500. In the past 15 years, Treasuries (notes and bonds) returned an annualized return of 13% during months when equities fell more than 5% (Figure 1). This compares to cash which returned only 1.2%. While the current starting point of cash yields is attractive, hovering near 5%, and offers better returns than in the past 15 years, so do longer-dated goverment bonds: their higher yield cushion potentially offers more capital appreciation in the event of an economic slowdown or recession in Canada and the U.S.

Figure 1: Returns when equities fall more than 5% in a month

Source: BMO GAM, Bloomberg. Since 1/1/2008, as of September 2023 data.

Besides their greater ability to cushion diversified long-term portfolios, another favourable element to strategically increase the fixed-income allocation is because we are nearing the end of the monetary policy tightening cycle. The peak of the Fed rate hiking cycle tends to be a good time to increase allocations to fixed income as 10- and 30-year bond-yields peak while the economy slowly enters either a soft landing or recession.

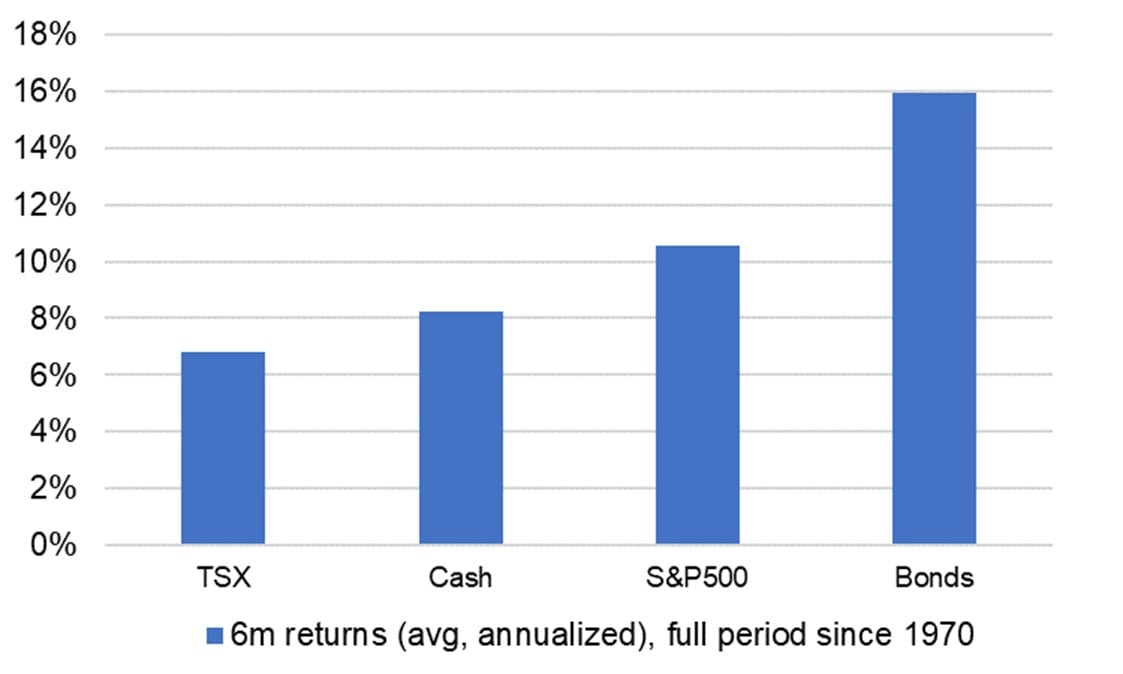

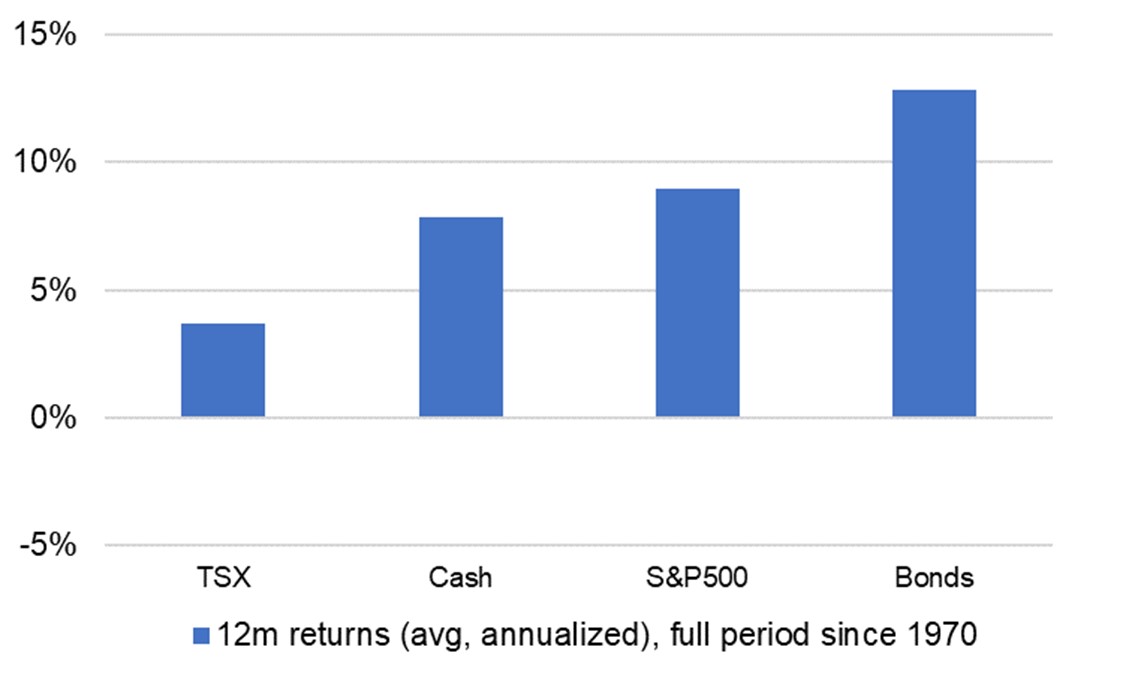

We think long-term investors should consider increasing portfolio interest-rate sensitivity through a lengthening of duration, which is looking like an attractive play through 2024 and 2025. Looking at past rate hikes cycles since 1970, US 10-year Treasuries outperformed both cash and US equities six months after the last Fed hike (Figure 2). Looking at returns twelve months after the last hike, bonds continued to outperform cash and equities.

Note that the returns for cash are heavily skewed by the high-rate environment of the 1970s and 1980s. After 1990 when U.S. fed fund rates were lower, cash returns fall to roughly 5% on average. In the current environment, if the Fed leaves rates on hold at current levels for the next twelve months, we can expect cash returns of about 5%. We view this as an upper bound, because if the Fed cuts rates, future cash returns will be lower.

Figure 2: Asset returns 6 months after last Fed rate hike

Source: Bloomberg, BMO GAM. Monthly data since 1/1/1970. 2). Dates of last Fed hike: May 1974, Mar 1980, May 1981, Aug 1984, Feb 1989, Feb 1995, May 2000, June 2006, Dec 2018.

Figure 3: Asset returns 12 months after last Fed rate hike

Source: Bloomberg, BMO GAM. Monthly data since 1/1/1970.

Bottomline: bonds could be ready for a back-to-the future moment

The performance of fixed-income assets has been eye watering for investors since August 2020, but we think investors should avoid extrapolating the pain of the past three years out into the future. History shows that fixed income tends to shine, outperforming both cash and equities, after we hit peak yields and peak monetary policy. Although the big disinflation trend of the past 3 decades is unlikely to be repeated, we think the cyclical conjuncture looks quite attractive for fixed-income investors.

Disclaimers:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

The views and opinions of the author in this communication do not necessarily state or reflect those of BMO Global Asset Management.

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.