This is a special issue of BMO GAM’s Monthly House View. Our usual format will return in January.

From higher interest rates to near-record inflation, 2023 tested investors’ mettle.

This special issue of BMO GAM’s Monthly House View represents our best insights into what the coming year may hold—based on extensive research, hard data, and our team’s experience and expertise. With topics ranging from fiscal policy and corporate leverage to the emergence of Alternative investments and the state of the traditional 60% equity/40% bonds portfolio, these are 10 big investment trends to watch in 2024.

#1: Recession

How Bad is the Economic Consensus?

Source: Bloomberg, BMO GAM, as of October 31, 2023.

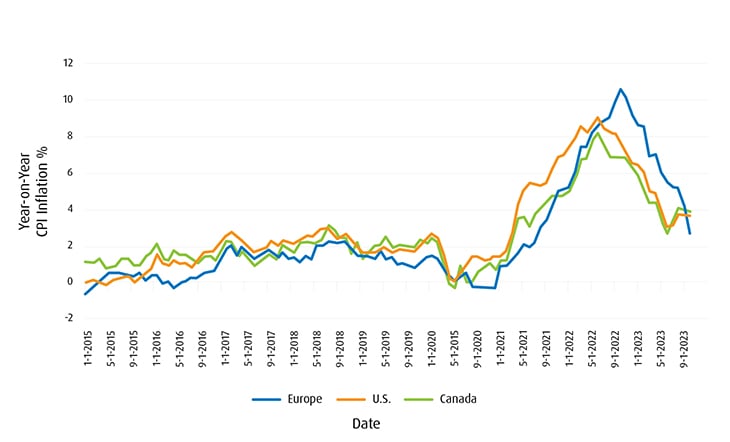

Are Rising Prices Transitory After All?

Inflation fears dominated 2023, with echoes of the double-digit inflation of the 1970s reverberating in investors’ minds. The good news is that over the past several months, rising prices have largely normalized, calming some of those concerns. Our expectation is that slowing economic growth should reinforce low and stable inflation into 2025—and that this normalization is likely to serve as a tailwind for equities and bonds.

Source: Bloomberg, BMO GAM, as of September 30, 2023.

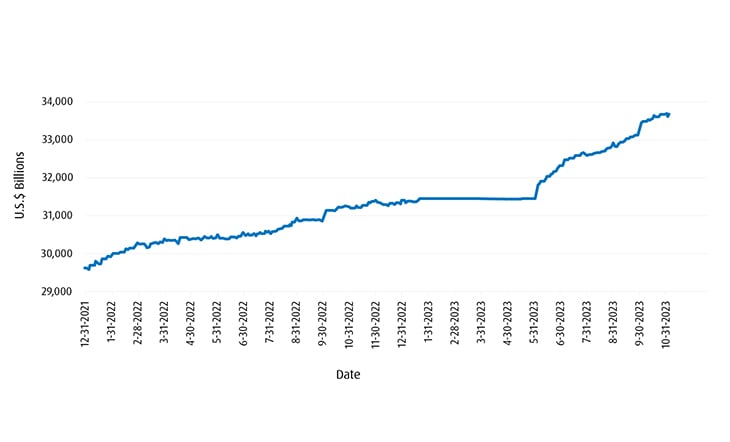

#3: Fiscal Policy

Will Higher Interest Rates Revive Fiscal Hawks?

Needless to say, higher-for-longer interest rates do not mix well with governments’ rising debt burden. In the United States, net interest outlays for 2023 surged past $1 trillion and are continuing to rise. At the same time, public opinion seems to be shifting, with voters indicating increasing unhappiness with the ongoing policy mix. Is austerity the answer? Unlikely—history tells us that fiscal austerity virtually guarantees a recession. In our view, the path of least resistance for policy-makers is lower interest rates, and perhaps tolerance for an inflation rate of 3% rather than the traditional 2% target.

Source: Bloomberg, BMO GAM, as of October 31, 2023.

Source: Bloomberg, BMO GAM, as of October 31, 2023.

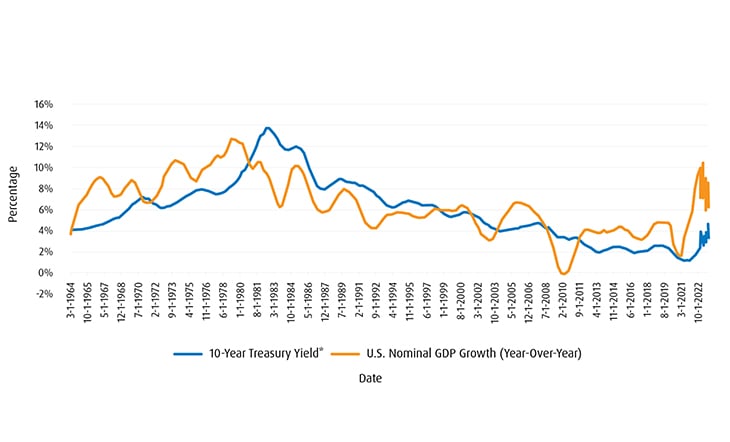

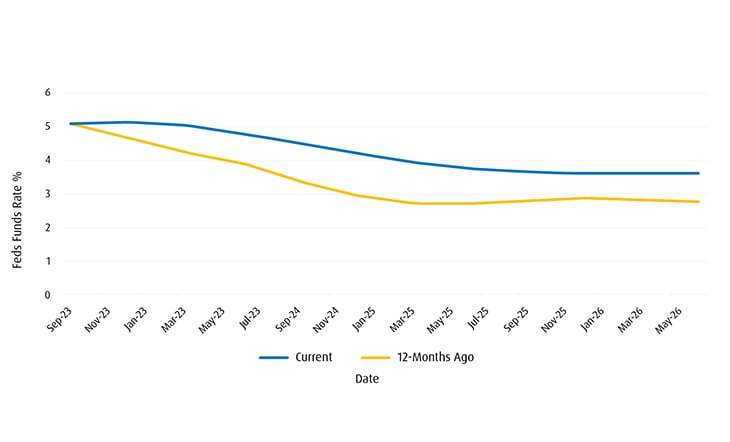

#4: Monetary Policy

Higher-for-Longer Interest Rates Will Be Tested

As the debt burden grows, real economic growth and inflation are poised to continue cooling into 2024. Fixed income markets see higher-for-longer as the most likely scenario, but we think even a soft landing could mean much lower interest rates—albeit perhaps not a return to a zero-interest rate policy (ZIRP) of the 2010s.

Source: Bloomberg, BMO GAM, as of November 8, 2023.

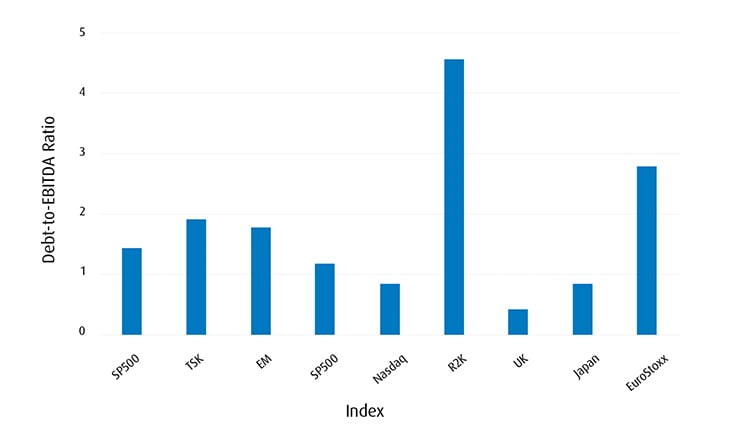

#5: Corporate Leverage

Watch for the Rise of the Zombies

Source: Bloomberg, BMO GAM, as of November 8, 2023. EBITDA: Earnings before interest, taxes, depreciation, and amortization.

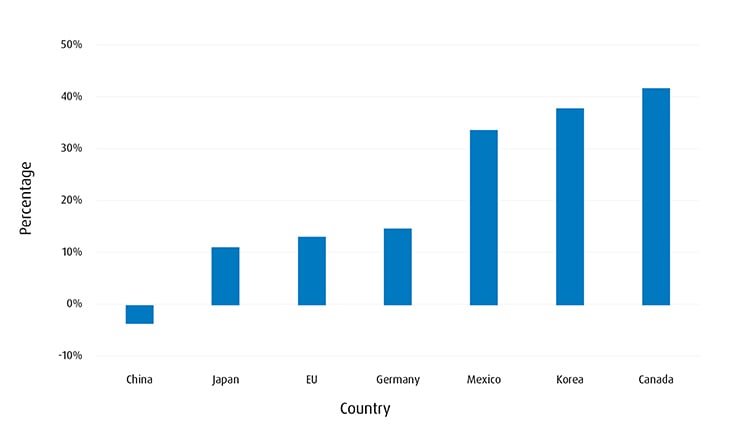

Deglobalization or Regionalization?

Tensions between the United States and China ratcheted up in 2023, and that may continue into 2024. But do not confuse the deglobalization trend with regional, “friendly” shifts in global trade. So-called ‘nearshoring’ or ‘friend-shoring’ means that for countries aligned with the U.S., like Canada, trade opportunities are likely to grow.

Source: Bloomberg, BMO GAM, as of September 30, 2023.

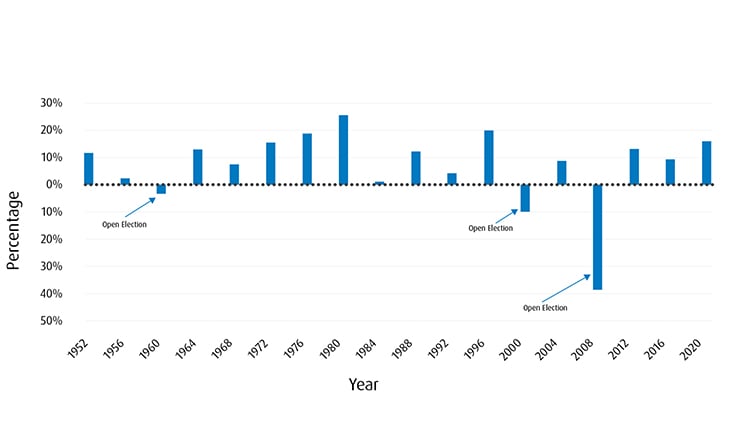

U.S. Presidential Election Years Are Usually Good for Stocks

Here’s a compelling statistic: since 1952, the S&P 500 has not declined in a year in which an incumbent president was running for re-election. Yes, stocks have occasionally declined in election years, but in each of those three cases—1960, 2000, and 2008—it was an open election with no incumbent running. Why is this the case? In short, presidents tend to use whatever policy levers are needed to boost the economy, shore up their support, and maximize their chances of being re-elected.

Source: Strategas Research Partners.

Join the Revolution

Technology companies, including the ‘Magnificent Seven,’ are finding new ways to expand their already-dominant businesses. In 2023, we witnessed the increasing footprint of transformative technologies like A.I. across all aspects of economy activity, including the old economy—industries like manufacturing and agriculture. Don’t be surprised if Big Tech continues to lead in 2024.

Tech Platforms: Time to Reach 100 Million Users

Rank | Platform | Launch | Time to 100M Users |

|---|---|---|---|

1 | Threads | 2023 | 5 days |

2 | ChatGPT | 2022 | 2 months |

3 | TikTok | 2017 | 9 months |

4 | WeChat | 2011 | 1 year; 2 months |

5 | Instagram | 2010 | 2 years; 6 months |

6 | Myspace | 2003 | 3 years |

7 | WhatsApp | 2009 | 3 years; 6 months |

8 | Snapchat | 2011 | 3 years; 8 months |

9 | YouTube | 2005 | 4 years; 1 month |

10 | Facebook | 2004 | 4 years; 6 months |

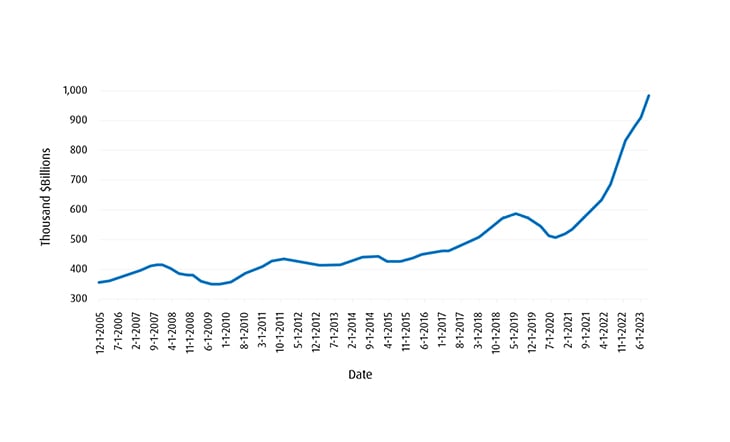

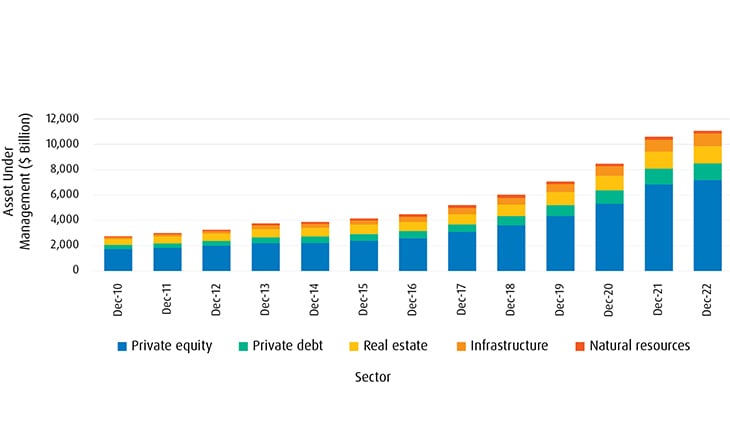

The Quest for Diversification Will Accelerate

The Growth of Alternative Investments (2010-2022)

Source: Preqin Pro, as of January 18, 2023.

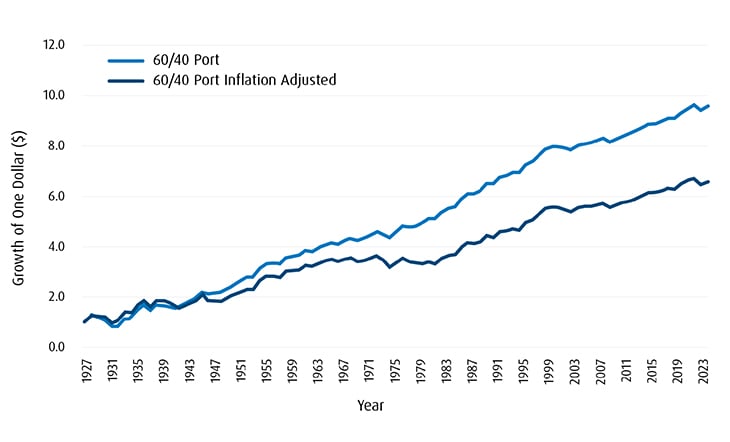

Time to Embrace the Ballast of Higher Interest Rates

2023 has delivered several positive surprises to investors as the economy navigated through a challenging environment dominated by elevated inflation and interest rates. In many ways, we think investors should feel more confident heading into the new year as the worst of the storm is largely behind us. We expect 2024 to be more about the long-and-variable lags of monetary policy. In contrast to 2023, this should help limit the scope for meaningful upside economic surprises and potentially reveal recession scars, most notably in Canada, but also in Europe. In this context, 2024 should see central banks normalize their policy stance and cut interest rates. While we think there is a wider set of macroeconomic paths for fixed income to shine in 2024, the performance of equities might ultimately depend on how successful central banks will be at delivering a soft landing, especially in the U.S. The continuation of ‘immaculate disinflation’ would likely be a moderate tailwind for risk assets, but we also recognize that history has generally not been kind to equities when global economic activity rolls into a recession.

In many ways, we think investors should feel more confident heading into the new year as the worst of the storm is largely behind us.

Disclosures

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.